Contents

10 performance & financial reports every Managing Partner needs

Running a successful law firm requires more than being an expert on the practice of law. A competitive firm requires business leadership and it’s the business mindset that will help set you apart from your peers.

In business, data is power. Data on your clients, the market, legal trends, your staff, finances, and performance. There is an endless list to the analysis you could do and the KPIs you could set yourself and your firm. But having visibility of the key areas of your firm will provide you the opportunity to make smarter, data-driven decisions.

Understanding your law firm’s data puts you in control. Data provides the insight to spotting trends, highlighting problems, and implementing solutions. Having the insight to your firm’s performance will have a major impact on your firm’s profitability, growth, and success.

In this guide we’ll look at why a firm should monitor law firm KPIs, how to use law firm KPIs and what reports every firm should be monitoring to give you the information you need.

What are law firm KPIs?

Law firm KPIs, Key Performance Indicators, are a business metric. They are quantifiable values that measure the success of a firm’s efforts in achieving their specific goals. This could be to increase revenue, clients, or referrers for example. Or it could be to improve profitability, customer retention or staff satisfaction.

The KPIs you measure will depend on your individual goals, so these need to be mapped out first to determine how you’ll measure success. These values are then measured regularly throughout a set period to determine the likelihood of success, monitor ongoing performance and to implement course correction.

4 Benefits of law firm KPIs

Insight

An obvious benefit into monitoring your performance but setting KPIs and analysing reports is more than just collecting data. With clear goals in mind, you can now use the data to inform the decisions you make to progress forward. The data you collect can be compared to your objectives so you can identify if improvements need to be made to stay on track.

Control

With insight comes control. A clear plan of action and real-time data to track your progress provides Partners and Senior Managers with complete visibility to make the decisions that affect the future actions of the firm. When data is driving business decisions you not only have the control to make successful decisions in the present but trend analysis to make smarter decision for the future.

Accountability

With actionable KPIs comes accountable participants. Individuals, teams, or departments have clear benchmarks, targets and aims to focus their attention and ensure responsibility is taken for those successes or failures. When you know who or what is responsible for the outcomes, you know what to replicate or avoid going forward.

Scalability

With visibility of the processes, people and strategies that are working and those that are not, you’re able to remove the unwanted burdens and put resource into the successes. This means you can tighten and improve on the processes that are costing you money. With efficiencies and productivity improved, your ability to scale improves. Getting the foundations of your firm right, frees up opportunities for growth.

Challenge the status quo

Time is money – but law firm KPI’s and reporting are more than just measuring profit per partner. To better understand how you attract, win, and keep clients is important to have a 360-degree view of all areas of your firm.

Measure things that give you useful data to move forward. Client satisfaction is critical today, they have so much choice that a negative review could mean a lot for your reputation. Measuring these stats is new but important. It gives you the feedback you need to know where to improve and where to spend your time to get the best value for your efforts.

Do you track the right data?

You can only measure what you track, so take stock of what your processes allow you to monitor. Does your practice management software provide you with the right data? Typically, if the data is inputted, you can extract it, especially if your practice management software provides business intelligence tools.

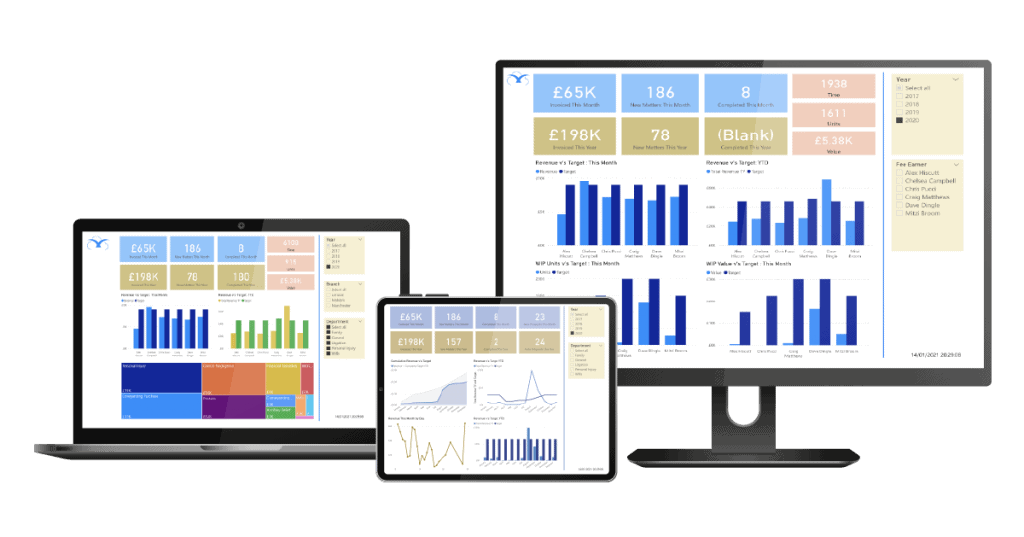

KPIs can be presented in dashboards or reports. Comprehensive case management solutions also allow you to design, configure and schedule reports so you and your team will always have the data you need, when you need it.

We asked our Case Management Developer, and previous high-street law firm Practice Manager, Ben, to list the key reports every Practice Manager needs to gain full visibility of their law firm.

10 reports every law firm should schedule

1. Billing analysis

This is the most crucial report for forecasting future budgets and staffing decisions. If you want to know how to grow, you’ll need to be able to analyse your billing.

Set up monthly and year-to-date reports highlighting actual vs target billing figures. With that base report, also show variance by individual Fee Earner and department so you know your star performers. It’s also useful to show comparison to last year’s figures over the same period so you know if you’re heading for growth or need to adjust to meet target.

Having these details will help measure ongoing performance but will also help make data-driven forecasts on fees in upcoming months. This helps you better align staffing resource, annual leave, growth opportunities and adjust budgets.

2. Time tracking analysis

Accurate time tracking equals accurate billable time. Understanding your time tracking will help you understand how to improve and ensure your staff are meeting the needs of the business and using your software solution to correctly record their hours.

Make sure the report shows recorded time by Fee Earner and department including non-chargeable and chargeable time plus equivalent work in progress value. Set up the report so you can see any variance in time record targets.

A detailed time tracking report will allow you to compare the work you’ve invoiced for vs the actual work performed – useful for understanding the profitability of a flat fee. It will also determine the profitability of an individual fee earner, department, or work area so you can choose to relocate funds and resource if necessary.

With visibility of the facts, you can make smarter decision on price increases, resource allocation, department growth or closure and time spent on marketing and business development. The data will also allow you to determine if the billing cycle needs to be adjusted and if the firm would benefit from interim bills or charges at various stages of transactions.

3. New matters

Understanding the number of enquiries you receive, and your conversion rates put you in control of growing and progressing your firm.

Ensure you have monthly reports and real-time dashboards on the amount of new matters vs your target by Fee Earner and department. Include comparisons to last year’s figures to understand trends and improve forecasting.

4. Enquiry conversion rates

On top of the new matter reports, ensure you’re also monitoring the number of new enquiries you’ve had and the conversion rate from enquiry to instruction. Without these initial enquiry figures you won’t have the whole picture of how successful your firm is at winning new business.

Drilling down further, you should also monitor where the enquiry came from (website, phone, email) and the conversion rates against those channels. With this analysis you’ll be able to focus resource on the practice areas that are successful and profitable, on specific channels of marketing and into business development to effectively grow your firm.

5. Client analysis

Understanding your clients is just as important as understanding your financials. Knowing the behavioural trends of your typical and ideal clients will give you the advantage of exceeding their expectations and attracting new business.

Identifying your ideal client helps you to focus on winning more clients like them, as typically they’ll provide a more profitable return and easier experience. Using reports such as ‘top clients by fee income’ or ‘average payment days per clients and outstanding bills’ will help build the picture of who or what area of work requires more resource, and therefore, where you want to allocate spend for marketing and sales efforts.

The analysis will help you understand and serve your existing clients better so you can provide them with a first-class service while boosting the firm’s reputation. This in turn helps you attract new clients so results in a win win situation.

6. Aged debts

Your biggest cash flow challenge is late-paying clients. Keeping a tight track of your aged debt and decreasing the length of time for overdue payments will help your firm thrive. With the right data you can make smarter decisions on credit control policies, spot trends or challenging clients early and identify staff training needs for efficient money collection.

Set up reports for aged bills by time overdue (30-60 days, 61-90 days etc) and then by Fee Earner, department, and work type. The data will highlight the key problem areas and where to implement solutions first, but crucially will allow you to identify trends. Consider whether there are specific Fee Earners or departments that are creating cash flow issues or specific clients who need a stricter billing policy to avoid continuing to carry out work without payment.

Once your initial analysis is complete a regular scheduled report will allow you to scrutinise your credit control efforts and continue to make further improvements.

7. Unbilled disbursements

Improving cash flow is crucial to surviving future challenges and disbursements can become a considerable proportion of firm debt. Wherever possible you should bill disbursements immediately to help retain operational capital for your firm, whilst keeping tracks of unbilled disbursements is key for survival. With out-of-control client debt, it can be hard to remain resilient in facing unknown challenges.

Ensure the report details disbursements per Fee Earner and department that are both yet to be billed for and yet to be paid for by the client.

8. Cashflow forecast

With the individual elements that dramatically affect cash flow reported on, it’s important Senior Partners also have a top-level cash flow report to provide the full picture of your firm’s performance.

The report should detail actual vs forecasted cashflow for each income and expense nominal, showing an opening and closing bank balance for the year.

The data will help your firm make accurate predictions of its financial stability and effectively forecast for tough times. It will also highlight where the firm has under or overspent so actions can be taken to reallocate funds or enforce limits.

9. Dormant matters

Reporting on dormant matters can help improve the efficiencies of your firm. The report should identify matters that are inactive or without financial postings for a determined period.

This will highlight cases that need archiving or additional attention to help with progression. Understanding what is dormant and outstanding will also aid compliance if your firm is accredited by CQS or Lexcel. Regardless of compliance, it is good practice to ensure matters are effectively managed and filed.

10. Client money retention

It’s important to identify matters where money is being held for lengthy periods to avoid acting like a bank. Keeping track of these matters ensures you can monitor cases and act when you need to. This will also aid compliance to SRA accounts rules ensuring your firm is risk free of errors.

Increasing visibility and control for your firm

Increasing cashflow, improving profitability and winning new clients is at the top of every partners’ to-do list. The NatWest 2023 Legal Report highlighted that costs and salaries are increasing whilst profits are decreasing. This is why gaining visibility of your firm’s cashflow to reduce lock up days and WIP write-offs, whilst improving efficiencies to boost profitability is crucial to staying competitive.

Data-driven insights monitored against set KPIs is the only way to ensure you can navigate the future and combat those uncertainties. Using a practice management system that provides intuitive business intelligence, smart reporting and real-time dashboards will give your firm the visibility it needs, so you can focus on making the right decisions, not collating the right data.