NEW INTEGRATION – COMING SOON

Integrate Osprey Approach with Plaid

Instantly access a real-time bank feed for better cashflow visibility and send payment links directly to clients – all from one place.

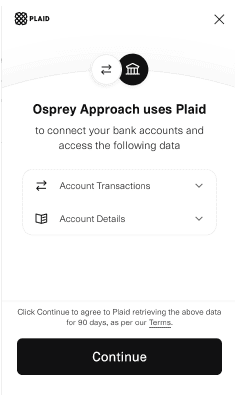

We are an agent of Plaid, who powers this integration. You can connect your current account via Plaid, who provides account information services (AIS) securely through us as their agent.

Your firms bank data – connected

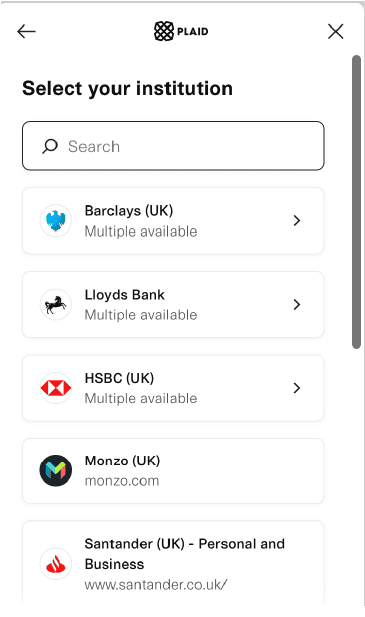

Connect your bank accounts securely

Osprey Approach uses Plaid to link your firm’s bank accounts with ease. Simply select your institution and authorise access to transactions and account details. Even accounts team members without direct bank access can manage cashflow securely and accurately – keeping your firm compliant and efficient.

Manage multiple accounts effortlessly

Plaid supports multiple accounts across different banks, giving your team a complete view of firm and client finances. Improve visibility of cashflow – all from Osprey – without switching between platforms or logging into multiple banking portals.

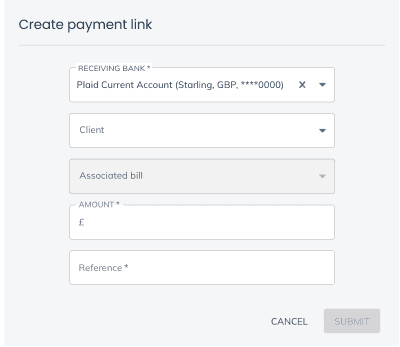

Create payment links in seconds

Get paid quicker with integrated payment links in Osprey. Using the Plaid integration, We can offer our clients a low-cost online payment service that competes with leading suppliers on value. Easily generate secure payment links, for any bank account connected in Osprey, so your clients can pay their invoices instantly. .

- What is Plaid?

Plaid is a secure platform that connects your bank accounts to software applications. In Osprey Approach, it allows your firm to automatically sync financial data, reconcile accounts, and manage payments more efficiently.

- How does the Plaid integration work with Osprey Approach?

Once linked, Plaid pulls in data from your firm and client accounts in real time. You can view balances, transactions, and payment history directly within Osprey Approach without manual entry.

- Can I send payment links to clients through this integration?

Yes. Plaid enables secure payment links to be generated and sent directly to clients, making it faster and easier to receive funds while keeping your records accurate.

- Is my financial data secure?

Absolutely. Plaid uses industry-leading encryption and security protocols, and Osprey Approach never stores sensitive banking credentials. Your client and firm data remain fully protected..

- Can I link multiple bank accounts?

Yes, you can connect multiple accounts across different banks to get a complete view of your firm’s finances in one place.

- Will this integration save my firm time?

Definitely. By automating reconciliation, syncing accounts, your firm can reduce admin hours and focus on client work.

- What are the costs of the Plaid integration?

Pricing for the Plaid integration is available on our Osprey pricing plans page. Visit the page to see your options and find the right plan for your firm.

Find out more about the Plaid integration

Access better software support and an all-in-one solution

Upgrade your practice and case management system today, to Osprey, and make it easier to run your firm. Book an initial demo to see the software in action, get pricing details, and information on our implementation and data migration services.