Comprehensive AML workflow for law firms

Streamline your compliance efforts, enhance efficiency, and mitigate risks with our innovative AML workflow automation tools. The Osprey AML workflow transforms the complexities of anti-money laundering regulations into a user-friendly system, enabling your firm to conduct thorough risk assessments as mandated by the SRA. With customisable templates that align with regulatory requirements, this workflow simplifies the client onboarding process, reduces the risk of errors, and provides clear visibility throughout your compliance journey.

AML risk assessment workflow features:

Seamless integration with case management

Seamlessly add AML compliance checks into your everyday case management workflows. This workflow enables fee earners to complete AML tasks as part of their usual processes, with managers accessing visibility and reports when needed.

Customisable and workflow templates

Osprey’s AML workflow comes pre-configured to align with SRA standards. Customise templates with fields and processes that suit your firm’s specific compliance needs, making client risk assessments more efficient and simplifying audit preparation.

Use as standalone or within exisiting workflows

Operate the AML workflow independently, or embed it into existing client or matter workflows to streamline compliance tasks and keep risk management centralized within your case management system.

AML compliance recording

Track client risk levels, review assessment completions, and access document histories with Osprey’s comprehensive reporting suite. This allows compliance teams to easily monitor progress and maintain control over firm-wide AML efforts.

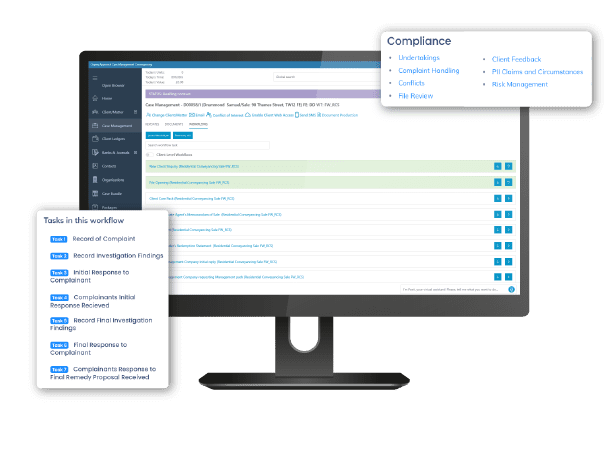

See compliance workflows in action

Osprey’s suite of compliance workflow templates include:

Risk management

File reviews

Undertakings

PII Claims

Conflict

Complaints

Client Feedback

Smart time-saving automations to increase revenue

With manual tasks automated, scaling is simple, and your firm is freed up to take on more matters and clients. Osprey’s powerful legal workflow software helps your firm to work smarter, data collection, document creation, critical date management, time recording, and client communications are automated and streamlined so you can focus on higher value work.

Access better software support and an all-in-one solution

Upgrade your practice and case management system today, to Osprey, and make it easier to run your firm. Book an initial demo to see the software in action, get pricing details, and information on our implementation and data migration services.