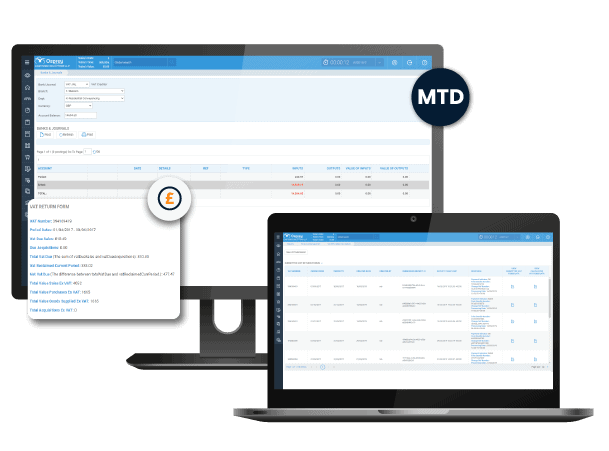

Legal software compatible with HMRC’s Making Tax Digital

Digitally submit your VAT submission to HMRC via Osprey. Our comprehensive legal accounting solution is compatible with Making Tax Digital (MTD) so you can file your VAT returns directly from your legal practice & case management solution. Avoid data duplication, improve accuracy, and speed up accounting processes with Osprey.

Nominal ledger software features:

Automatic VAT calculations

VAT is automatically calculated and recorded when you post to your client or nominal ledgers.

Digitally submit VAT returns

Easily submit your VAT returns via Osprey using HMRC’s Making Tax Digital portal.

Manage VAT journal

Manage and edit your VAT journals for each brand and department via Osprey to keep your financials accurate and up to date.

Track VAT history

Via Osprey view your submitted VAT returns, your payment history, and how much VAT you owe.

VAT reports

A core set of reports can be used within Osprey to keep track of all vatable transactions and total period figures.

Legal accounting software for UK law firms

Osprey helps you to manage the day-to-day running of law firm by streamlining and connecting your finances with your practice and case management solution. Without the need of additional software systems, you can manage your office accounts, client ledgers, bill clients, submit VAT, manage multi-currencies, track time, and report on your financial performance within one central solution.

View the VAT accounting software in action

Access better software support and an all-in-one solution

Upgrade your practice and case management system today, to Osprey, and make it easier to run your firm. Book an initial demo to see the software in action, get pricing details, and information on our implementation and data migration services.