Complete Anti-Money Laundering Checks Digitally

Protect your law firm and speed up compliance checks with digital due diligence services from InfoTrack. Easily complete anti-money laundering (AML) checks online, through Osprey, that are automatically returned to your matter helping you quickly onboard clients. Complete your AML checks with confidence that it meets regulatory body requirements using InfoTrack and Osprey.

Watch the Osprey and InfoTrack Integration

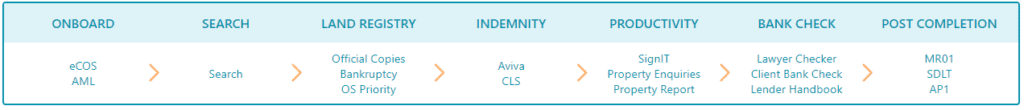

InfoTrack offers a suite of digital conveyancing services from property searches to verification checks, AP1s, property reports, and more. When integrated with Osprey Approach, law firms have access to a powerful platform to deliver efficiency and quality digital conveyancing services.

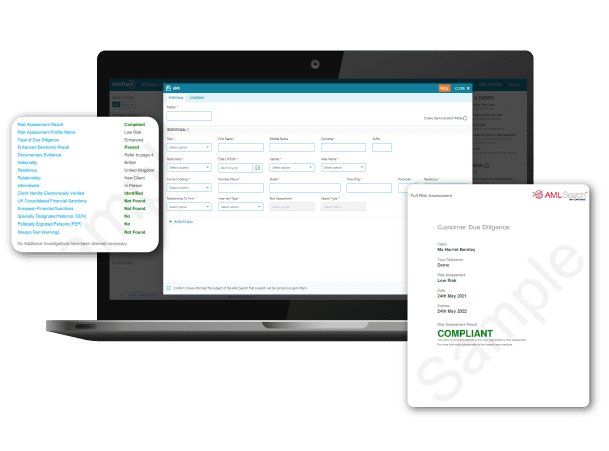

InfoTrack AML Check Software Features:

Pre-populated data

Client and case data stored in Osprey is used to automatically populate the AML checks forms in InfoTrack.

AML dashboard

Easily track all your clients and their results in addition to new status alerts.

Order AML checks online

Order anti-money laundering checks alongside other conveyancing searches and services from the InfoTrack platform, through Osprey.

Instant results

The ‘compliant’ or ‘non-compliant’ result is delivered within seconds, ensuring you’re provided with the information instantly.

Ongoing monitoring

Ongoing monitoring means you will be notified throughout the transaction if any PEPs, Sanction, or other alerts appear on your client.

Update tool

Through the update service, a non-compliant result can be changed to compliant without ordering another search.

Conveyancing Case Management Software

Automate the time-consuming and admin-heavy conveyancing tasks to save you time, reduce the risk of compliance errors, and to deliver quality client service. The Osprey conveyancing practice and case management software solution helps to digitalise and streamline your cases from initial enquiry and client onboarding, to post completion. Discover how you can streamline your residential and commercial property cases.

InfoTrack Services

Access and order a wide variety of searches, checks and reports through InfoTrack via Osprey’s case management solution. The InfoTrack forms are auto populated with data stored in Osprey and completed reports and files are saved back into the matter history to help you deliver an efficient and effective service. Centralise your conveyancing processes in one connected platform so you drive long term efficiencies for your firm.

InfoTrack products and service include:

- What is an AML check?

Anti-money laundering checks are one of many due diligence checks that law firms are required to complete to prevent fraud. Completing an AML check helps to identify if client funds have been illegally obtained or are legitimate sources of income. The due diligence procedures are required for new and existing clients and form part of the onboarding process in any property transaction.

- How long does an AML check take?

With the InfoTrack integration, you’ll receive a ‘compliant’ or ‘non-compliant’ result in seconds.

- How often do you need to do an AML check?

An initial AML check is part of the onboarding process both for new and existing clients, and ongoing monitoring should be conducted throughout the transaction. Through AMLV4, you will be automatically notified if there is a change to the result, e.g. if the client gets added to a sanctions list. You must keep records of your customer due diligence documents for five years.

- What does my firm need to do to comply with the SRA?

You need to inform the SRA of the service you wish to provide and get approval for the relevant people as defined in the regulations. You also need to:

-Risk assess your firm, relevant clients and matters

-Identify and verify identities of your clients and any beneficial owner of your clients

-Identify sources of funds and wealth where relevant

-Train your staff to recognise red flags

-Appoint a money laundering reporting officer to alert the National Crime Agency where they suspect they have encountered the proceeds of crime

-Where relevant to the size and nature of the business undertake an independent audit, screen your staff, and appoint a money laundering compliance officer (MLCO) to supervise your compliance work

For full details visit the SRA website.

- What is an MLCO?

A money laundering compliance officer should be a member of senior management at a law firm and is the main contact to the SRA for any AML matters. They should ensure they have sufficient knowledge the practice’s money laundering and terrorist financing risk exposure and authority to take decision affecting risk exposure. They are responsible for screening, training, and auditing processes.

For full details visit the SRA website.

- Does my firm need to carry out AML checks?

There are three areas of AML activity that the SRA monitor. If your law firm operates in any of these areas or provide these services, you need to comply with the AML regulations.

The three areas include:

Independent legal professional proving services in financial or real property transactions, trust and company service providers offering services in forming companies or tax advisors.

For the full breakdown of these three areas, visit the SRA website.

Find out more about the powerful InfoTrack integration

Access better software support and an all-in-one solution

Upgrade your practice and case management system today, to Osprey, and make it easier to run your firm. Book an initial demo to see the software in action, get pricing details, and information on our implementation and data migration services.