Streamline processes for private client cases

Increase productivity and reduce the time spent completing repetitive tasks using Osprey. Standardise your data capture processes, speed up document production, and automate time-consuming admin tasks. Utilise a centralised, single platform to manage your wills and probate cases so you can focus on delivery exceptional client care.

Work on the go

We know private client lawyers are often away from their desk, perhaps on a home visit, so we’ve made sure you can access Osprey no matter your location. With all your documents and data stored in the cloud you can easily and securely access all the Osprey features and integrations from any device.

Pavilion Row use automated workflows within Osprey to boost efficiencies

“The workflows allow us to easily monitor the work we’re doing and from a management point of view, it allows us to oversee processes and ensure we’re delivering the right level of service. Workflows also ensure we’re being consistent and so in all areas of the business we use workflows for the key compliance tasks during the file opening process to ensure that we’re doing all the appropriate checks and we’re not missing anything.”

Nicola Houston, Operations Director, Pavilion Row

Access any document you need at a click of a button

Never lose track of a file again with Osprey’s centralised, comprehensive document creation and storage solution.

Osprey’s private client software helps you produce, organise, and access an unlimited number of legal documents and forms. Easily keep a record in Osprey of all the original wills and LPA documents you hold so your COFA and COLP can keep track of any movements or withdrawals, ensuring important documents aren’t lost and best practices are followed.

Wills & probate law software key features:

Configurable workflows

Streamline your tasks and standardise processes by making use of the customisable private client workflows available including specialised wills, LPAs and probate.

Auto-populate data

Auto-populate any form or document template with the client data you already store in Osprey to reduce errors by rekeying data.

Form production

Access a library of over 2,000 free forms within Osprey, including essential forms like the IHT variations and PA1s. Plus, access additional forms in Osprey via the Lexis Smart Form integration.

Automated calculations

Osprey’s workflows automatically populate many of the IHT form calculations, saving you hours of time.

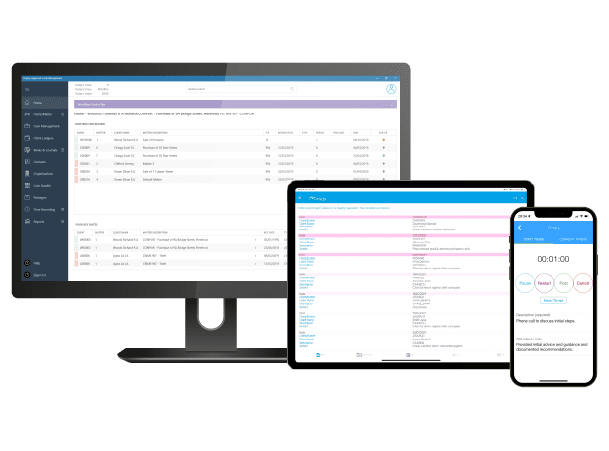

Integrated time recording

Record your tasks in real-time with the time recording app. Whether you’re at the office or with clients, ensure you’re accurately billing your hours.

TextAnywhere integration

Keep your clients regularly informed by scheduling timely text messages using the TextAnywhere integration.

- What is case management software?

Private client case management software allows practitioners to manage their probate, Lasting Power of Attorney and Wills matters. The A cloud-based Case management software (CMS) centralises all your documents, data and files so they can easily be accessed from any location. A CMS lets you prepare and store documents and forms as well as offering time recording, contact and organisation management, a client web portal, compliance and reporting features and automated workflows for a complete package. Find out more about the Osprey case management solution.

- Is Osprey right for my firm?

Osprey Approach is suitable for any firm size and practice area. The solution includes features and functionality that are beneficial for all including specialised apps and workflows that ensure you have the tools you need to complete your cases. You can be confident, when using Osprey, that your manual admin will be reduced, productivity will increase and client service will be enhanced. Use Osprey Approach to transform the way your work.

- What other applications does Osprey integrate with?

Yes, Osprey Approach integrates with many of your favourite, powerful software applications and services such as DocuSign, Microsoft 365, InfoTrack and many more. Manage your entire firm through a centralised platform so you can streamline operations. Discover all our integrations here.

- Does Osprey’s private client case management software include functionality for wills, probate and LPAs?

Yes, you can manage all these areas from within Osprey and have access to our pre-built, specialised workflows for these types of matters. You also have the option of using, where appropriate, the client web portal which allows you to communicate and share documents with your clients in a secure environment.

- How do I get started with Osprey?

It’s simple – contact our sales team for a full demonstration to ensure the solution meets your needs and we can begin your implementation process at an appropriate time for your firm.

Once implemented our support team will be available to provide remote training and support (included within your licence fee) at any time throughout your contracted period so you can always feel confident using our solution. - Does Osprey include will & probate forms?

Osprey has a library of over 2,000 free legal forms that your team can access. Easily edit forms in Microsoft Word, auto-populate them with data you store in Osprey, and securely share with clients.

We also integrate with Lexis Smart Forms so you have access to all the forms you’ll need across your firm.

See a selection of our will & probate forms from our legal forms library below:

HMRC Inheritance tax forms:

Inheritance Tax account (IHT100)

Inheritance Tax: gifts and other transfers of value (IHT100a)

Inheritance Tax: termination of an interest in possession (IHT100b)

Inheritance Tax: assets ceasing to be held on discretionary trusts – proportionate charge (IHT100c)

Inheritance Tax: non interest in possession settlements – principal charge (10 year anniversary) (IHT100d)

Inheritance Tax: charges on special trusts (IHT100e)

Inheritance Tax: cessation of conditional exemption – disposal of timber or underwood (IHT100f)

Inheritance Tax: alternatively secured pension chargeable event (IHT100g)

Inheritance Tax: return of estate information (IHT205) for deaths before 6 April 2011

Inheritance Tax: return of estate information (IHT207 (2006))

Inheritance Tax: claim to transfer unused Inheritance Tax nil rate band (IHT216)

Inheritance Tax: claim to transfer unused nil rate band for excepted estates (IHT217)

Inheritance Tax: application for a clearance certificate (IHT30)

Inheritance Tax: claim for relief — loss on sale of shares (IHT35)

Inheritance Tax: claim for relief – loss on sale of land (IHT38)

Inheritance Tax account (IHT400)

Inheritance Tax: domicile outside the United Kingdom (IHT401)

Inheritance Tax: claim to transfer unused nil rate band (IHT402)

Inheritance Tax: gifts and other transfers of value (IHT403)

Inheritance Tax: jointly owned assets (IHT404)

Inheritance Tax: bank and building society accounts (IHT406)

Inheritance Tax: household and personal goods (IHT407)

Inheritance Tax: household and personal goods donated to charity (IHT408)

Inheritance Tax: pensions (IHT409)

Inheritance Tax: life assurance and annuities (IHT410)

Inheritance Tax: listed stocks and shares (IHT411)

Inheritance Tax: business and partnership interests and assets (IHT413)

Inheritance Tax: Agricultural Relief (IHT414)

Inheritance Tax: interest in another estate (IHT415)

Inheritance Tax: debts due to the estate (IHT416)

Inheritance Tax: foreign assets (IHT417)

Inheritance Tax: assets held in trust (IHT418)

Inheritance Tax: debts owed by the deceased (IHT419)

Inheritance Tax: National Heritage assets, conditional exemption and maintenance funds (IHT420)

Inheritance Tax: probate summary (IHT421)

Apply for an Inheritance Tax reference (IHT422)

Direct Payment Schemes for Inheritance Tax (IHT423)

Inheritance Tax: reduced rate of Inheritance Tax (IHT430)

Claim the residence nil rate band (RNRB) (IHT435)

Claim transferable residence nil rate band (IHT436)

Inheritance Tax: election for Inheritance Tax to apply to asset previously owned (IHT500)

Power of attorney (LPA) forms:

Forms to register a lasting power of attorney (LPA) including LP PA, LP PW, LPA114 or LPA117.

Notice of intention to register an enduring power of attorney (EP1PG)

Apply to register an enduring power of attorney (EP2PG)

Notes for completing application form EP2PG

Object to registration of EPA (EP3PG)

Disclaimer by a proposed or acting attorney under a lasting power of attorney (LPA005)

Object to registration of LPA: donor (LPA006)

Object to registration of LPA: factual grounds (LPA007)

Object to registration of LPA: notify OPG (LPA008)

Probate forms:

N205D Notice of issue of claim and service of probate claim form

N3 Acknowledgment of service (probate claim)

Form PA1A: Apply for probate by post if there is not a will

Form PA1P: Apply for probate by post if there is a will

Form PA1S: Find a will or probate document

The Osprey Approach all-in-one legal software solution for SME law firms

The Osprey Approach solution combines comprehensive case management, powerful practice management, compliant legal accounting, and streamlined client management that helps make running your law firm easier.

- Legal Case Management Software

Improve efficiency, productivity, and profitability with an effective, centralised legal case management software that ensures regulatory compliance and reduces human errors. Osprey is a true end-to-end system that manages the case management lifecycle from initial query to completion.

Features of our case management solution include:

- Law Practice Management Software

Our powerful, multi-device cloud-based software has helped thousands of lawyers to run a profitable firm and deliver excellent client care. With a comprehensive suite of features built into our software, all areas of your legal practice will be connected and streamlined to maximise success.

Features of our practice management solution include:

- Legal Accounting Software

Without time-consuming admin tasks, you can speed up the month-end processes and run a streamlined accounts department with ease. Our legal billing software allows you to centralise your accounts into one system, which reduces errors, improves productivity, and provides the visibility you need to drive your firm forward.

Features of our legal accounting solution include:

- Client Management Software

Exceed your clients’ expectations and provide a convenient and modern onboarding and case management experience using Osprey Approach. The software helps you to balance driving efficiencies for the firm whilst delivering excellent client care.

Features of our client management solution include:

Access better software support and an all-in-one solution

Upgrade your practice and case management system today, to Osprey, and make it easier to run your firm. Book an initial demo to see the software in action, get pricing details, and information on our implementation and data migration services.